The Strategic Guide to SaaS Renewals: How Enterprise Leaders Can Eliminate Supplier Sprawl

SaaS Renewals aren't just about negotiating price; they're strategic opportunities to eliminate supplier sprawl, consolidate vendors, and reshape your tech stack.

Let's consider this: what if renewals weren't about securing discounts, but about fundamentally reshaping your tech stack/portfolio?

According to Gartner's 2026 IT Spending Forecast, enterprise software spending will not contract and will remain above $1.4 trillion. In parallel, large enterprises typically manage 200+ SaaS renewals annually, creating a continuous cycle of decision points. Given the above data, we must accept that software spend will increase, but control over that spend exists only at renewal.

At each renewal, we have an opportunity to reduce costs and eliminate redundancy. Renewals are the only moment when we have real leverage. They are strategic inflection points, our only real opportunity to rationalize tech stacks, consolidate vendors, and align our software investments with actual business needs.

This guide will show you how to transform renewals from a box-checking reactive transaction into proactive portfolio management.

Reason Behind Failure of Traditional Renewal Management—Supplier Sprawl

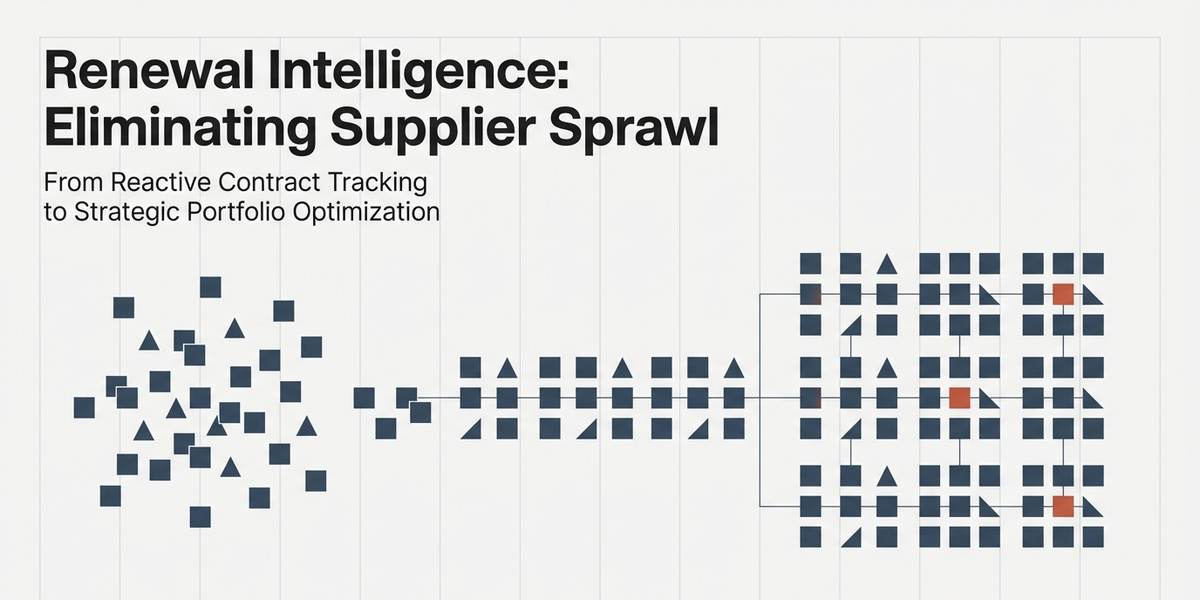

Most renewal strategies focus on two things: tracking contract dates and negotiating price. It's a transactional approach that treats each renewal in isolation.

And in that process, we miss the bigger picture: Supplier Sprawl—the unchecked accumulations of overlapping, redundant, and underutilized software across organizations.

Consider this example from one of our case studies:

- Marketing buys HubSpot. Sales buys Salesforce Marketing Cloud. Customer Success buys Intercom. Three different teams, three different tools, significant functional overlap, and no one realized it until all three came up for renewal in the same quarter.

- Now, when those renewals surface, the decision is no longer tool- or vendor-specific; it is ecosystem-wide. Renewing a single tool is not a standalone contract event—it cascades across the entire CRM ecosystem, marketing automation stack, customer data platform, and dozens of integrated applications. Miss that broader context, and organizations simply roll forward duplicate capabilities, overlapping vendors, and softwares that no longer fits your workflow.

This is Supplier Sprawl in Action. And it compounds with every renewal you handle in isolation.

Hidden Costs of Reactive Renewals—Economics of Supplier Sprawl

According to the 2025 SaaS Management Index, the financial impact of the Sprawl is staggering. Here is how the data looks

- License Waste: Large enterprises lose more than $100 million annually due to unused licenses. These aren't minor rounding errors; they represent a systematic failure in license management and usage tracking.

- Redundancy Cost: Organizations have the potential to save anywhere from tens of thousands to over $700k simply by consolidating their most redundant application categories. Imagine paying for three project management platforms, five communication tools, and seven analytics solutions—all doing essentially the same thing.

- Vendor Sprawl: The average organization now manages 200+ applications, with portfolios growing over 30% annually. Every renewal you handle in isolation compounds this sprawl.

- Auto-Renewal Risk: More than three-quarters of software contracts are on one-year terms with automatic-renewal clauses. Miss the cancellation window by even a few days, and you're committed to another full cycle, even if you don't need it.

What makes this particularly insidious is that business units now control roughly 70% of all software spending, making it nearly impossible for central procurement to maintain visibility into what's actually being purchased and renewed. The real cost isn't just money—it's opportunity cost. Every dollar spent on redundant or underutilized software is a dollar not invested in tools that actually drive business outcomes.

Reframing Renewals: From Transactions to Strategic Decisions

And why Spreadsheets Can't Solve this

Many teams try to manage renewals using contract-tracking spreadsheets. You know the ones: columns for vendor name, contract value, renewal date, owner, and status. This works fine when you have 20 contracts.

It completely breaks down at 200+.

Why? Because spreadsheets track contracts, not portfolios. And renewals aren't about individual contracts its about portfolio optimization.

This shift, from reactive renewal tracking to proactive application rationalization, changes everything. Instead of asking "What price should we pay?"

We're asking:

- Do we still need this application?

- Does it overlap with existing tools?

- Can we consolidate vendors to reduce complexity?

- What's the business impact of keeping vs. eliminating this tool?

- Are we using it efficiently enough to justify the cost?

These aren't procurement questions. They're strategic business questions that require cross-functional intelligence—which is exactly what automated supplier intelligence delivers.

What Renewal Intelligence Actually Means

If traditional renewal management is about tracking contracts and negotiating price, renewal intelligence is about understanding your entire software ecosystem before making any single renewal decision.

The Four Pillars of Renewal Intelligence

- Complete Portfolio Visibility

We can't make smart renewal decisions without knowing what we have. Not just contract details but the full picture:

- Every application in use (including shadow IT)

- All spending sources (procurement, expense reports, departmental budgets)

- Ownership and stakeholders

- Usage patterns and adoption metrics Functional overlaps and redundancies

And in most enterprises, software procurement happens through multiple channels:

- Central procurement systems (the official channel)

- Departmental budgets (marketing tools, sales enablement, etc.)

- Expense reports (individual subscriptions, small team tools)

- Direct vendor relationships (especially after M&A)

Traditional discovery methods, such as asking teams what they use, auditing invoices, and similar approaches, miss shadow IT and decentralized purchases.

Here, AI-powered supplier intelligence & AI-powered category management solve these by automatically mapping every software touchpoint across your organization, regardless of how it was purchased.

- Functional Overlap Analysis

When a renewal comes up, you need instant answers to critical questions:

- Do we already have similar capabilities? Traditional SaaS management tools tell you what you own. Product comparison shows you functional overlap—identifying which tools can actually replace each other based on features, not just categories.

- What would consolidation look like? Vendor consolidation analysis shows you exactly what you'd save by merging suppliers and which applications could be eliminated.

- Does it meet our security and compliance requirements? Automated supplier research pulls security posture, compliance certifications, and technical fit—so Legal, Security, and IT aren't chasing the same information.

- What are the alternatives? Before you renew, you need to know what else is available. Side-by-side feature comparisons help you determine whether the current vendor remains the best fit.

For example: You're renewing your Zoom subscription. On the surface, this seems straightforward—video conferencing is an essential tool; renew it. But what if Microsoft Teams (which you already pay for as part of Office 365) now includes comparable video features? What if Slack (also in your portfolio) added Huddles functionality that handles 80% of your use cases?

This is where application rationalization becomes critical. Instead of treating Zoom as an isolated decision, you're evaluating it within the context of your entire collaboration stack—identifying where capabilities overlap and where consolidation makes sense.

- Proactive Cost Avoidance & Vendor Consolidation

The best renewal savings come from not renewing at all, when you discover you don't need the tool because you already have equivalent functionality

Cost avoidance works by flagging redundancies before renewals happen. When an application comes up for renewal, the system automatically:

- Identifies similar products already owned

- Highlights overlapping capabilities from existing suppliers

- Surfaces duplicate contracts for the same application

- Calculates potential savings from elimination

Beyond functional overlap, there's vendor overlap, situations where you're buying multiple products from different suppliers when one vendor could handle it all. Vendor consolidation analysis answers these questions by showing you:

- All products you currently license from each supplier

- Additional capabilities they offer that match your needs

- Quantified savings from consolidation vs. maintaining separate vendors

- Migration complexity and timeline considerations

This transforms renewals from "How do we pay less?" to "Should we pay at all?"

- Stakeholder Alignment

Renewal decisions impact multiple teams: end users, IT, Security, Legal, Finance, and Procurement. Coordinating all these stakeholders through email threads and meetings doesn't scale when you're managing 200+ renewals annually.

Stakeholder surveys and automated business cases create a shared workspace where:

- Technical teams confirm functional fit

- Security validates compliance requirements

- Business owners confirm usage patterns

- Finance reviews budget impact

The result? Faster decisions backed by cross-functional consensus, not endless approval loops.

Renewal Framework: A Role-Based Approach

Different stakeholders care about different aspects of renewals. Here's how renewal intelligence serves each role:

- Procurement Leaders

Your Challenge: Demonstrate savings, manage vendor relationships, and prevent budget overruns—all while keeping renewals on track.

Your Renewal Intelligence:

- Automated spend visibility across all sources (not just procurement systems)

- Vendor consolidation opportunities with quantified savings

- Real-time renewal pipeline with risk flags for auto-renewals

- Data-backed business cases for difficult consolidation decisions

The Impact: Procurement teams using Teem report 20-35% reductions in redundant software spend and 50% faster procurement cycles.

Key capabilities you need:

- Automated category management showing all software in each functional area

- Side-by-side product comparisons to validate alternatives during negotiation

- Business case generation for consolidation recommendations

Learn more: Teem for Procurement Teams

- IT & Enterprise Architecture

Your Challenge: Maintain a coherent tech stack while business units buy their own tools. Ensure integrations work, security is maintained, and technical debt doesn't spiral.

Your Renewal Intelligence:

- Technical fit analysis showing overlap in capabilities

- Application rationalization mapped to business needs

- Integration complexity assessment before renewals

- Security and compliance posture for each supplier

The Impact: IT can finally enforce architecture principles without being the "department of no." You're providing alternatives, not just roadblocks.

Learn more: Teem for IT Teams

- For Finance Teams

Your Challenge: Control operating expenses, forecast accurately, and demonstrate ROI on technology investments.

Your Renewal Intelligence:

- Complete spend visibility (including shadow IT and expensed purchases)

- Savings pipeline from vendor consolidation and cost avoidance

- Renewal forecasting with contract term visibility

- Category-level spend benchmarking

The Impact: Finance gains visibility into modeling scenarios, quantifying savings, and aligning software spend with business outcomes.

Learn more: Teem for Finance Teams

- For Sourcing and Category Managers

Your Challenge: Develop category strategies, identify consolidation opportunities, and execute strategic sourcing—all while managing day-to-day renewals.

Your Renewal Intelligence:

- Automated category analysis showing portfolio composition

- Supplier capability mapping for strategic evaluations

- RFx automation for competitive renewals

- Custom taxonomy support to match your organization's structure

The Impact: Move from firefighting individual renewals to executing long-term category strategies.

Learn more: Teem for Sourcing Teams | Teem for Category Managers

The 90-Day Renewal Readiness Protocol

Once you have renewal intelligence in place, you need a repeatable process for acting on it. Here's a proven framework:

90 Days Out: Strategic Assessment

Goal: Understand if this renewal represents an optimization opportunity.

Actions:

- Review usage metrics (login frequency, feature utilization, license allocation)

- Run functional overlap analysis to identify redundancies

- Check for vendor consolidation opportunities

- Gather initial feedback from business owners on satisfaction and requirements

Decision Point: Is this a straightforward renewal, a consolidation opportunity, or a potential elimination?

60 Days Out: Alternative Evaluation and Stakeholder Alignment

Goal: Build the case for the optimal path (renew, consolidate, or eliminate).

Actions:

- Run detailed product comparisons if considering alternatives

- Engage stakeholders via structured surveys (IT for technical fit, Security for compliance, end users for requirements)

- Build a data-backed business case showing cost impact and migration complexity

- If consolidating, develop a preliminary migration roadmap

Decision Point: Align leadership on the recommended approach and secure approval for next steps.

30 Days Out: Execution and Negotiation

Goal: Execute the decision with maximum leverage.

If renewing:

- Enter negotiations armed with alternative vendor data and competitive benchmarks

- Rightsize license counts based on actual usage

- Negotiate flexibility (shorter terms, usage-based pricing, escape clauses)

If consolidating:

- Negotiate termination terms for the outgoing vendor

- Secure better pricing from the consolidated vendor based on the expanded scope

- Finalize migration timeline and resource allocation

If eliminating:

- Notify vendor per contract terms (typically 30-90 days before auto-renewal)

- Coordinate user migration to alternative tools

- Document savings and update category strategy

Special Case: M&A and Portfolio Integration

Mergers and acquisitions create the ultimate renewal complexity: suddenly, you're managing two complete tech stacks with massive duplication.

Post-merger, every renewal becomes a critical integration decision:

- Company A uses Workday. Company B uses SAP SuccessFactors. Both renewals are due within six months. Which do you standardize on?

- Both entities use Salesforce, but in different editions with distinct customizations. How do you consolidate contracts and data?

- The acquired company has 40 tools you may not be familiar with. Do you renew while you figure things out, or force migration immediately?

Teem's M&A rationalization capabilities address this by:

- Rapidly mapping both portfolios to identify all overlaps

- Comparing capabilities to determine which tools to standardize on

- Quantifying synergies from consolidation vs. maintaining separate systems

- Creating phased migration roadmaps tied to renewal timelines

This transforms M&A integration from a multi-year slog into a strategic opportunity to eliminate sprawl and capture immediate synergies.

Negotiation Strategy: Beyond Price Discounts

Once you have intelligence and a clear renewal decision, negotiation becomes strategic rather than tactical.

Leverage Alternatives Analysis

Walking into a renewal discussion with a detailed alternative analysis fundamentally changes the dynamic.

You're not making vague statements. You're presenting data:

"Competitor X offers 90% of the features we use for 35% less. Here's the side-by-side comparison. Match the pricing, or we're evaluating a switch."

Vendors take this seriously because it's credible.

Consolidate First, Then Negotiate

If you're renewing with a multi-product vendor (Salesforce, Microsoft, Adobe, Atlassian), run consolidation analysis before negotiations begin.

Example: You're renewing your Salesforce Sales Cloud subscription. But you also have separate contracts for Marketo (marketing automation), Tableau (analytics), and MuleSoft (integration). Could you consolidate these into a single unified Salesforce contract and negotiate enterprise pricing?

Vendors offer much better terms when you're expanding the scope, not just renewing what you have.

Negotiate Flexibility, Not Just Price

Price matters, but contract terms matter more over time:

- Shorter initial terms: If you're uncertain about future needs, negotiate 6-month renewals rather than committing to a year.

- Usage-based pricing: For variable workloads, negotiate pricing that scales with consumption.

- Co-terminus dates: Align multiple contract renewals with the same vendor on a single date for consolidated negotiation.

- Escape clauses: Build in termination rights tied to specific events (M&A, product deprecation, security incidents)

These provisions prevent you from getting locked into commitments when business circumstances change.

From Calendar Tracking to Portfolio Intelligence

Here's the fundamental shift:

Traditional renewal management treats each contract as an isolated transaction. Track the date, negotiate a discount, sign, repeat.

Renewal intelligence treats renewals as portfolio optimization moments. Before deciding whether to renew, you understand:

- What else do you own that does the same thing

- Whether consolidating vendors would reduce complexity and costs

- What alternatives exist, and how do they compare

- Whether you should renew at all

Organizations that make this shift report:

- 20-35% reduction in redundant software spend

- 50% faster procurement cycles

- $10M+ in savings from portfolio consolidation

But more importantly, they gain control. Instead of software sprawl driving the organization, they're proactively shaping their technology portfolio to align with business strategy.

That's what renewal intelligence delivers: the ability to make strategic decisions at the speed and scale that modern enterprises require.

Take Control of Your Renewals and SaaS Portfolio

Teem's mission is to eliminate supplier sprawl to reduce risk, cost, and complexity.

Ready to Eliminate Supplier Sprawl?

Visit www.teem.finance or schedule a time with our CEO, Ben Mappen.